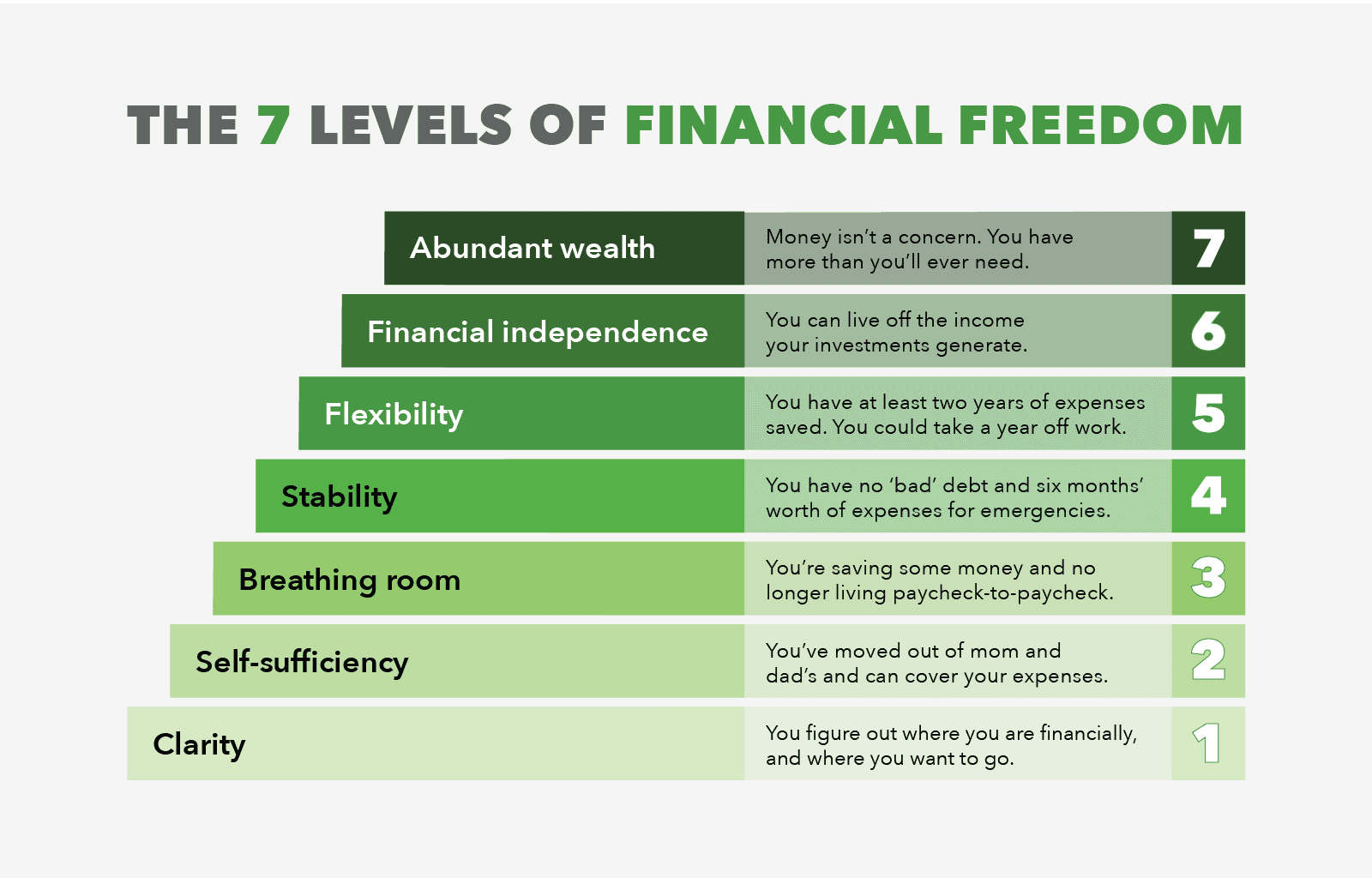

The 7 Levels of Financial Freedom

Hector Lamarque recently posted a graphic on X outlining the 7 levels of financial freedom and I found it to be a super simple layout and a great starting point for anyone looking to measure, track and improve their level of financial freedom.

Do you worry about money? Is it a burden on you sometimes? Does it cause anxiety or stress?

Remember, Rich Man’s Gym is about strength and conditioning for body, mind and spirit and while money cannot buy you happiness it definitely allows you more freedom and choice in life. And as you work up through the levels and create more financial freedom for yourself and your family you’ll see that money becomes less stressful.

As my mentor and boss Grant Cardone puts it, the goal isn’t comfort, it’s freedom. So right now, let’s take a look at these 7 levels of financial freedom. Look for where you are on this scale and start thinking about how you’re going to get to the next level (and the next, and the next, and… the next.)

Level One: Clarity

You figure out where you are financially and where you want to go. One of the things that keeps us stuck and experiencing lack is not having any clear cut financial goals and targets. So this is step one. Answer this question, what are you going financially? What are your goals and how much will they cost? Lastly, who will you be helping along the way?

Level Two: Self-sufficiency

You’ve moved out of mom and dad’s and can cover your expenses. All your bills are getting paid on time, you have decent to good credit and that’s it. This can be a very dangerous place. This is where you can easily get stuck and where a ton of false beliefs about money life. Let me just keep it simple with this. Money isn’t everything, until it is…

Level Three: Breathing room

You’re saving some money and are no longer living paycheck to paycheck. Having extra money in the bank feels good! Something on the side to handle unexpected expenses. This is where you can also start implementing one of Grant Cardone’s tips and mindsets from his Millionaire Booklet which is “save to invest”. Start setting money aside with the intention to eventually invest that money into a cash flow producing asset. There is a harsh reality here though. Even though you’re not living paycheck to paycheck and you got a little let over to pay for a vacation or an emergency, the reality is; you’re still broke. Sorry/not sorry.

Level Four: Stability

You have no “bad debt” and 6 months worth of expenses for emergencies. If having some breathing room feels good that stability feels great. What is bad debt? Well let’s start with good debt. Good debt is you taking a loan to by a positive cash flow producing asset. Bad debt basically means buying things on credit that ultimately you have nothing to show for it. Using a high interest rate credit card to finance a luxury vacation on the same credit card you’re charging clothing, dinners, nights out with no tax benefit… follow? If you have bed debt, you probably already know it and should have a plan to get rid of it asap.

Level Five: Flexibility

You have at least 2 years of expenses saved and could take a year off work. Can you imagine having enough money set aside that if it all goes wrong, you’re good for the next two years? What would that look like? Where would you put that kind of money? What kind of revenue would that generate all on its own? Check this out. AMEX has a 4.25% APR High Yield Saving Account right now. Let’s say you save up $30,000 and put it in there. Then every week you add $350. In 5 years you’ll $138,043 with $17,122 coming from just the interest. Average American makes 60k a year. Then what? What kind of choices will you have at this point? Are you investing into things that produce cash flow?

Level Six: Financial Independence

You can live off the income your investments generate. Where else are you investing your money? Can you get your money working for you rather than you working for your money? That should be the goal as you’re climbing these 7 levels of financial freedom. Owning assets that product positive cash flow. This is how the wealthy roll and this is how we can roll too.

Examples of cash flow producing assets would be dividend paying stocks, multifamily real estate, REITs, bonds, AirB&B, owning a business (online or brick & mortar), and royalties are all examples of cash flow producing assets. Start researching and learning about how you can leverage these to generate enough cash flow to fund your goals and dreams.

Level Seven: Abundant Wealth

Money isn’t a concern. You have more than you’ll ever need. Another term we can look at here is generational wealth. At this point you’re all set to the degree that not only could you not spend it all, you’re future family, like the people in your family that haven’t even been born yet are good to go and will never have to worry about money. Not a bad place to be at all financially speaking of course.

Next Steps…

Turns out, after some research these 7 Levels of Financial Freedom is from a book called written by Grant Sabatier. The book is already in my cart as well as the Audible which leads me to nexts steps for us. Here’s five things I’ve learned from Grant Cardone and Brandon Dawson to get you started

- Decide to get to your next level with Financial Freedom as you’re ultimate goal.

- Study ONLY people who have already done this and study a lot of them.

- Do NOT take advice from ANYONE who has not already achieved Financial Freedom.

- Pick the top two you favor and jive with most and assign them mentor status and really study them and how they made it.

- Get super clear on your goals, your why and then set daily, weekly and monthly targets to achieve your next level and once you hit it, reset all of it and level up again. Keep in mind, each level will require a shift in think; an evolution if you will.

Lastly, make sure you’re doing all of this for a purpose great than just money. As we said in the beginning, money will not buy happiness but it will deliver to you freedom and choices and you will be able to do more with money than without. The reality is we live on an economic planet and you will need it to reach your goals and your dreams.